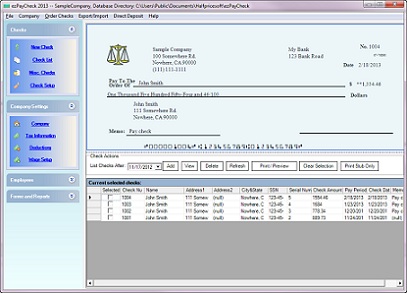

EzPaycheck small business payroll software is user friendly, super simple and totally risk free. The software is ideal for owners of small to mid-sized businesses who have only basic computer skills and little accounting know-how. Build in all 50 states and D.C tax tables; Create and maintain payrolls for multiple companies; Print your own checks on blank computer check or preprinted check paper; Print any purpose checks; Print image signature on checks; Calculate and Print out w2, w3 forms and Quarterly 941 report, Yearly 940 report; Automatically calculates Federal Withholding Tax, Social Security, Medicare Tax and Employer Unemployment Taxes; Automatically calculates 50 states and D.C. tax; Easy to follow wizard guides through the company creation process and Employee setup; Support Daily, Weekly, Biweekly, Semimonthly and Monthly payroll periods; Easy to use reports.