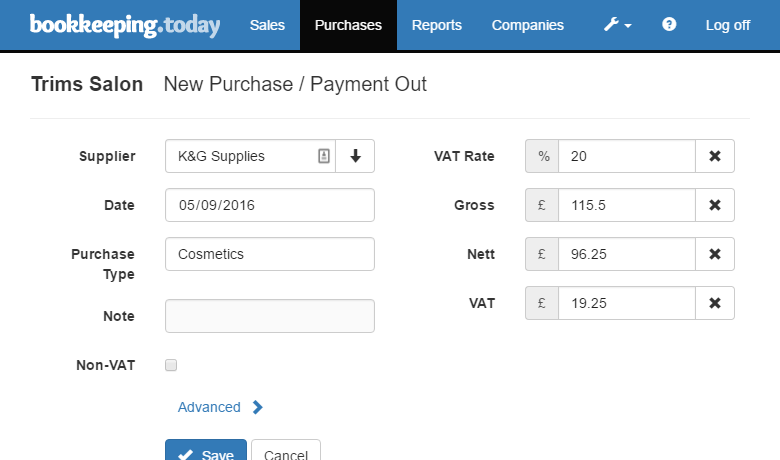

Simple Bookkeeping Software On Any Device. Bookkeeping Today is a simple cash-book for small businesses. You can record your sales, purchases and other transactions, and if you are VAT registered, you can produce your full VAT Return, and EC sales figures if you are exporting. Bookkeeping is much simpler than accounting (especially the way we do it), and takes much less of your time. With Bookkeeping Today you can keep clear records, giving your accountant less work to do, and save on accountancy fees. Compatible with PC, Mac, Android and iOS. You are free to do your bookkeeping anywhere and on any device. Making Tax Digital for VAT VAT registered companies in the U.K. can take full advantage of HMRC's Making Tax Digital for VAT system. You can submit your VAT Returns, view previously submitted returns, and check your history of VAT liabilities and payments. Spreadsheets For Your Accountant When They Need Them. When it's time for your accountant to do your accounts or taxes (or whenever you need), you can easily save your data as a spreadsheet file. Bookkeeping Today produces MS Excel files, a standard format that all accountants use. Multiple Companies Bookkeeping Today was built to be multi-company. You can run several companies with a single login, each with it's own set of accounts. Are you bookkeeping for 2, 5 or 100 businesses? Bookkeeping Today will make that easy for you.